TATM Budget After Thinking Template™️

Designed by a lawyer who struggled with spending in his 20s—and now teaches personal finance to law students and young lawyers.

You’re not bad with money.

You were just never taught what to do with it.

Most young lawyers:

- are managing their first real salary

- are juggling student loans and rising expenses

- feel pressure to “have it together” financially

And yet still feel unsure about where their money goes.

That’s not a personal failure. It’s a missing system.

Why I built this.

I was a lawyer in my 20s making good money and still stressed about spending.

Not because I was reckless—but because no one ever taught me how to manage a real paycheck, debt, and lifestyle changes at the same time.

I eventually figured it out.

Now, I teach personal finance to law students so they don’t have to learn the hard way like I did.

This budgeting template is the tool I wish I’d had as a young lawyer.

What this template helps you do.

This isn’t about restriction or perfection.

It helps you:

- See exactly where your money is going

- Plan realistically with your current salary

- Balance spending, saving, and student loans

- Feel calm and intentional instead of reactive

All without complicated spreadsheets or apps.

Built specifically for young lawyers

Most budgeting tools assume:

-

No student loans

-

Lots of free time

-

A love for spreadsheets

This one doesn’t.

It’s designed for:

-

A fixed associate salary

-

Personal savings targets instead of broken rules like (save 20%)

-

Real life and real spending habits

Simple, realistic, and actually usable.

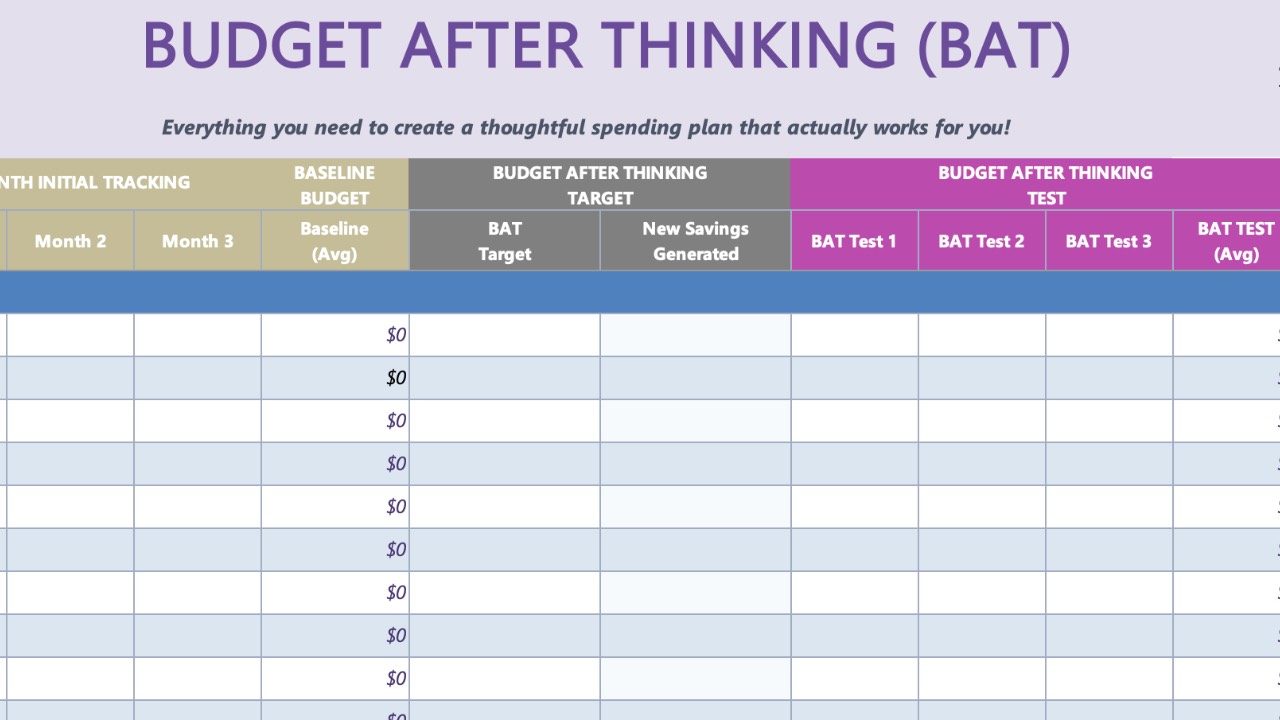

What’s included:

-

A downloadable budgeting template

-

Flexible categories tailored to young associates

-

Instructions for a total budgeting plan

-

A 6-month system designed so you don't have to budget forever

No apps to learn. No ongoing subscriptions.

Why it’s $25.

I wanted this to be:

- Accessible early in your career

- Low-pressure to try

- Worth far more than the cost

$25 is about the price of one lunch— and the clarity will last for your career.

This is perfect for you if:

-

You earn a solid salary but don't have a plan.

-

You're unsure where your dollars are going.

-

You don't want to budget forever- my system requires minimal effort, and realistic evaluation, for only 6 months.

-

You prefer simple tools over complex systems.

You don’t need to be perfect with money.

You just need clarity.

This budgeting template was built by a practicing lawyer and personal finance professor who’s been exactly where you are.

Get the budgeting template for $25.

Start feeling more in control of your money.

Testimonials from my Personal Finance for Lawyers Course:

“Prof. Adair is very welcoming and relatable. He cares a lot about his students and what he is teaching. He is clearly very knowledgeable in this area and was able to answer everyone’s questions. I am so grateful for his passion to spend the weekend with us!”

Killed it! Honestly, this may be the most important class I have taken in law school.”

“Should be taught twice a semester probably, so everyone can have a chance to take it.”

“This was a great and very important class for people to take… I think Professor Adair’s course should be a required class, especially for full-time students who are usually just out or recently out of college.”

How to Make a Budget After Thinking

In Part 1 of our budgeting series, we aim for planning ahead of time with a budget that stops the disappearing dollar and fuels our ultimate life goals.

How to Budget with a Real Life, Really Lost, Boy

In Part 2 of our series on budgeting, we'll use real numbers to create a Budget After Thinking to better align our spending with our true motivations in life.

How to Stay on Budget with Two Simple Numbers

There's an alternative to tracking every penny. You'll only track two numbers. It works if you're honestly dedicated to fueling your life goals.

Top 10 Budgeting Tips for Lawyers that Actually Work

In Part 3 on budgeting, we’ll take a deep dive into my top 10 strategies for making thoughtful adjustments so we can consistently win the budget game.